Recent Posts

How to Close More Reverse Mortgage Loans

Before I go into a cheap way to stay in contact with your reverse mortgage leads which will help you close more reverse mortgage loans. I am going to go on a little bit of…

Targeting Reverse Mortgage Niches Makes Marketing Way Easier

Even though reverse mortgages are a tiny little niche within the mortgage industry. You can dive deep within this niche to create marketing messages that work really well. And that is the key to any…

SEO for Reverse Mortgage Websites

I have recently tried out a couple of different linking resources to see how it would affect the rankings of the reverse mortgage websites I tested it on. The good news is that the results…

Where Does Your Reverse Mortgage Website Rank?

4 Tools To Track Your Reverse Mortgage Website Rankings (3 Free) You have a reverse mortgage website. That’s great. Are people finding it when they look for reverse mortgages on a local level? What I…

The Ultimate Reverse Mortgage Marketing Strategy = Sneaker Wave

Out of all the marketing things I do, there is one that still amazes me and it never fails to deliver reverse mortgage leads. And the VERY BEST thing about this mortgage marketing strategy is…

28 Reverse Mortgage Marketing Tasks To Outsource

In this blog post I am going to show you why, where and what you should be outsourcing for the marketing and advertising aspects of your reverse mortgage business. I love marketing. But there were…

How To Market Your Reverse Mortgage Business Using Podcasts Without Actually Podcasting

Podcasts are huge! I don’t know about you, but I am constantly seeing posts from friends on Facebook asking for recommendations for podcasts they should download and listen to. The good news is that you…

How To Tell If Your Reverse Mortgage Advertising Is Working Or Not

One of the things I always hated about advertising in general was not knowing if my advertisement, direct mail piece, radio ad, insert, post card or any other type of marketing and advertising was working…

Marketing Your Reverse Mortgage Business With Guest Posts

This Simple Reverse Mortgage Marketing Tip Will Help You Get More Traffic, Leads and Calls Guest posts are a fantastic way to help your mortgage website rank better for local search terms, drive more traffic…

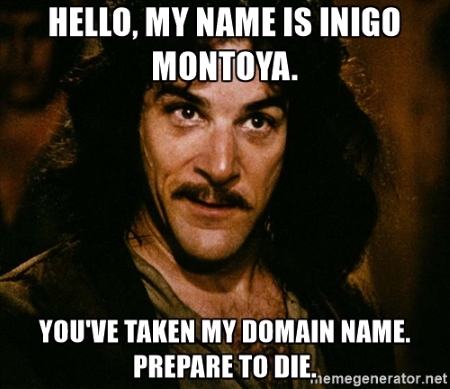

6 Reasons You Need A Mortgage Domain Name

Tens of thousands of loan officers are making a massive marketing mistake by not having a domain name they control. They either don’t see the need or the benefit to having their own mortgage domain…